Starting and growing a business in Washington, DC, comes with its challenges, but fortunately, there are numerous funding opportunities available to support entrepreneurs. Small business grants in DC serve as a lifeline for startups and existing businesses, providing non-repayable financial assistance to help them thrive. Whether you’re launching a new venture or looking to expand, understanding the landscape of small business grants in DC can make a significant difference in securing the necessary resources.

Understanding Small Business Grants in DC

Small business grants in DC are designed to encourage economic growth, innovation, and job creation in the area. Unlike loans, grants do not require repayment, making them an attractive option for business owners. However, they often come with specific eligibility criteria, application deadlines, and reporting requirements. The DC government, local economic development organizations, and private institutions all play a role in offering these grants, targeting various industries and business needs.

In today’s rapidly evolving digital landscape, finding reliable solutions for device management is crucial. Platforms like OpenUnlock offer seamless unlocking services that empower users to take full control of their gadgets without unnecessary restrictions. For professionals seeking insightful industry updates and expert advice, ConsultMeDaily serves as an invaluable resource, providing daily consultations and in-depth analyses tailored to various sectors. Additionally, when questions arise or support is needed, AskOurStaff ensures that users receive prompt and knowledgeable assistance, enhancing overall user experience and satisfaction.

Government-Funded Small Business Grants in DC

The DC government actively supports small businesses through a variety of grant programs aimed at fostering economic development. The Department of Small and Local Business Development (DSLBD) offers several funding opportunities, including the Great Streets Small Business Grant and the Commercial Property Acquisition Fund. These programs aim to revitalize neighborhoods, support minority-owned enterprises, and encourage entrepreneurship in underserved areas.

Additionally, the DC Office of the Deputy Mayor for Planning and Economic Development (DMPED) provides grants for businesses looking to expand or establish themselves in key commercial corridors. Programs such as the Neighborhood Prosperity Fund and the Vitality Fund Grant help businesses cover expenses related to property acquisition, renovation, and workforce development.

Federal grant programs also contribute to the availability of funding for DC entrepreneurs. The Small Business Administration (SBA) offers grants through initiatives like the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs, which support research-driven businesses working on innovative solutions. These grants cater specifically to businesses engaged in technological advancements and scientific research.

Private and Nonprofit Grant Opportunities

Apart from government initiatives, many private organizations and nonprofits provide small business grants in DC. Entities such as the Washington Area Community Investment Fund (WACIF) and the Latino Economic Development Center (LEDC) offer financial assistance to small businesses, particularly those owned by women, minorities, and economically disadvantaged entrepreneurs.

Corporate-sponsored grants also play a role in funding small businesses in DC. Companies like FedEx, Visa, and Amazon have grant programs aimed at fostering innovation and supporting local businesses. These programs vary in focus, with some targeting specific industries such as technology, retail, and sustainable businesses.

Nonprofit organizations such as the National Association for the Self-Employed (NASE) provide grants for small business owners looking to expand their operations. These grants typically require applicants to demonstrate financial need, a well-structured business plan, and a clear vision for how the funds will be utilized.

How to Apply for Small Business Grants in DC

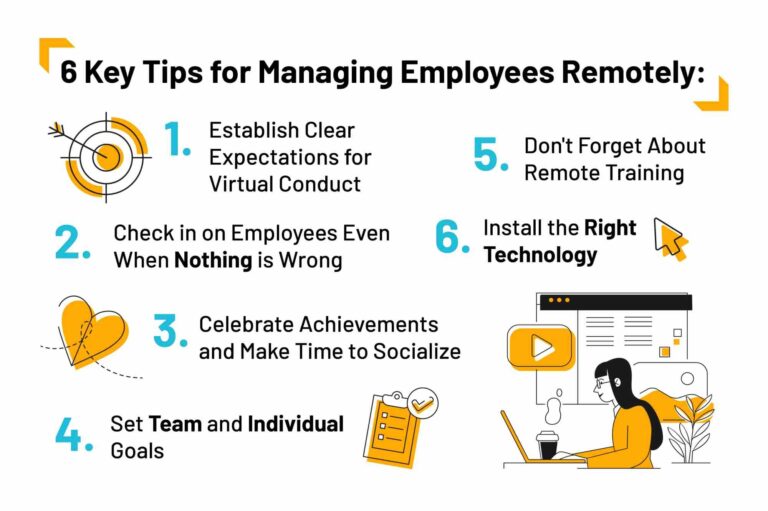

Applying for small business grants in DC requires careful planning, research, and a well-prepared application. Each grant program has its own set of eligibility requirements and application processes. The first step is to identify grants that align with your business needs and objectives. Researching grant opportunities through the DC government’s official website, nonprofit organizations, and corporate funding sources will provide a comprehensive understanding of what is available.

Once a suitable grant is identified, preparing a compelling grant proposal is crucial. Most grant applications require a detailed business plan outlining financial projections, growth strategies, and the intended use of the grant funds. Additionally, demonstrating how your business contributes to the local economy, creates jobs, or fosters community development can strengthen your application.

Grant applications often require supporting documentation, including financial statements, tax records, and business licenses. Ensuring that all necessary paperwork is organized and up to date will streamline the application process. Meeting deadlines is equally important, as missing submission dates can result in missed funding opportunities.

Challenges and Considerations

While small business grants in DC offer financial relief, the competition for funding is high. Many businesses apply for the same grants, making it essential to stand out with a well-crafted application. Additionally, some grants require businesses to match a percentage of the funds received, meaning that entrepreneurs must have additional resources available to leverage the grant effectively.

Compliance and reporting requirements are another factor to consider. Many grant programs require recipients to submit regular reports detailing how the funds are being used and the impact on business growth. Staying organized and maintaining accurate financial records will help ensure compliance and improve the chances of receiving future grants.

The Future of Small Business Grants in DC

As Washington, DC, continues to foster a thriving entrepreneurial ecosystem, the availability of small business grants is expected to expand. Government initiatives, corporate sponsorships, and nonprofit programs will likely evolve to meet the changing needs of business owners. Keeping an eye on new funding opportunities, networking with local business organizations, and staying informed about policy changes can provide a competitive advantage for those seeking grants.

For entrepreneurs in DC, small business grants represent an invaluable resource for growth and sustainability. By exploring available funding options, preparing strong applications, and meeting eligibility criteria, business owners can take advantage of these opportunities to build successful enterprises in the nation’s capital.